Member Login

Politics and Local 26

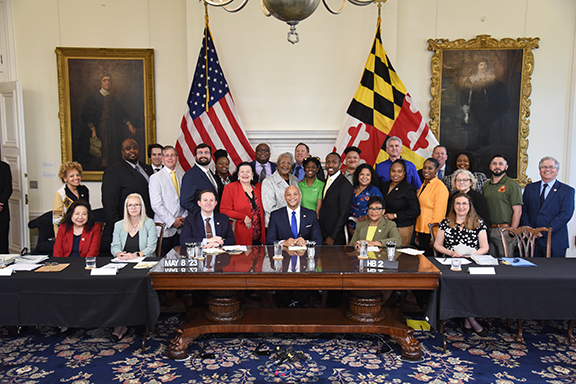

Maryland Governor Wes Moore Signs House Bills

Business Agent/Political Director Tom Clark and Business Agent Cordelia Evans were honored to bear witness of the signing of the following House Bills by Maryland Governor Wes Moore.

Maryland House Bill 2: (Union Dues) Allowing a subtraction modification under the Maryland income tax for certain union dues paid during the taxable year; and applying the Act to all taxable years beginning after December 31, 2022.

Maryland House Bill 830: (Residential Construction - Electric Vehicle Charging) Establishing and altering certain requirements related to the installation of equipment for the charging of electric vehicles during the construction of certain housing units; clarifying that a county or municipal corporation may require a greater number of electric vehicle parking spaces; requiring the Maryland Energy Administration to study certain issues related to the installation of electric vehicle parking spaces at multifamily residential buildings and submit a report to the Governor and the General Assembly by December 1, 2023; etc.

President Biden visits Local 26

Check out the article in IN Charge magazine

MD Governor Wes Moore visits Freestate Electric at UMD

Prevailing Wage in Fairfax County, VA

Please listen to the Fairfax County Supervisors’ remarks upon passage of the Prevailing Wage Ordinance January 25th (Article 13 at the 5:23 mark). You will hear references to the efforts the elected leaders put forth to make sure all public works in Fairfax County including public schools, fire houses, government offices and infrastructure reflect scale. Thanks to their push back against county bureaucracy our share of construction on public works will rise as bids reflect the prevailing market wage rate. Prince William County, Loudon County, and the City of Alexandria will pass similar prevailing wage ordinances in March and February. If you would like to help pass a prevailing wage ordinance in the county you reside, please contact our political department. Prevailing Wage was adopted on all Arlington County Projects and State projects in 2021.

Build Back Better Bipartisan Infrastructure Bill

Please help the IBEW gain more work by contacting your House Representative. Here is a script you can use while contacting your Congress Rep.

IBEW Action: IBEW Can Build the Future

Dear Sisters and Brothers,

The IBEW can – and will – build the future.

Democrats and Republicans, under President Biden’s leadership, have agreed on a truly Bipartisan Infrastructure Framework, which is a chance to rebuild our country and put hundreds of thousands of IBEW members to work. We can create millions of good union jobs. Unfortunately, some members of Congress are trying to stop it.

This plan will modernize our electrical grid, building thousands of miles of new transmission lines. It will invest more than $14 billion in the electric vehicle industry and install 500,000 charging stations to fuel them. It will reinvigorate domestic manufacturing and deploy high-speed broadband to rural and underserved communities. And it will make the most extensive federal investment in public transit and passenger rail, broadband and American manufacturing in history.

Last November, our votes helped elect a president and vice president who proudly support union workers. But the job’s not done. We have one chance to pass a plan that will strengthen our union for many years to come. This is a once-in-a-generation opportunity for us. Click here to take action.

Write to Congress and tell them to pass the Bipartisan Infrastructure Plan.

If you have any questions, please contact the Government Affairs Department via email to IBEWPowerstheFuture@ibew.org.

Let’s get to work!

In solidarity,

IBEW Government Affairs Department

Building America Back Better

Biden's Agenda is Working for the IBEW

Biden's Agenda is Working for the IBEW

Election 2020

The 2020 campaign is over and, once again, our membership shined as civic minded voters and advocates for the working person. No matter who you voted for, the fact that you voted is a plus for our Local and our community. We will continue to highlight our membership as patriotic citizens that vote in high numbers. Politicians will be made aware that the road to any state, county, or city office, goes through Local 26.

We would also like to thank all the members that volunteered their time towards electing “union-friendly” candidates. Your efforts in phone banking and literature drops made a difference. We admire your work and dedication. Thanks to all!

The PRO Act

A legislative priority for the AFL-CIO is HR 2474, the Protecting the Right to Organize (PRO) Act and it’s identical version in the US Senate, S. 1306. This legislation, would rewrite the rules around labor law in this country. The PRO Act was introduced in the US House of Representatives (HR 2474) by Virginia Congressman Robert “Bobby” Scott. The following MD, VA and District of Columbia representatives have signed as co-sponsors:

Maryland: Raskin, Cummings, Trone, Brown, Sarbanes, Ruppersberger and Hoyer

Virginia: Beyer, Luria, Spanberger, McEachin, Connolly and Wexton

District of Columbia: Holmes-Norton

The identical bill was introduced in the US Senate (S 1306) by Senator Patty Murray (D-WA). The following Senators have signed as co-sponsors:

Maryland: Cardin, Van Holland

Virginia: Tim Kaine

Virginia Senator Mark Warner have not signed-on to support this bill.

Tell him to SUPPORT THE PRO ACT (S. 1306)

Senator Warner’s Office: 703-442-0670

Politicians on Our Side

We at Local 26 are bringing in local politicians to show them what we can offer to their constituents in the way of training for a lifetime career in our trade. And also the type of training they should expect in the workforce that is building their projects in their County’s and Communities. We are in a full blown effort to secure more work for our members to be able to support their families for now and into the future.

|

|

|

|

I'll Be There Award

In November 2018, Business Manager George Hogan presented the DC Jobs with Justice "I'll Be There" award to Washington, DC, Attorney General Karl A. Racine. AG Racine has been vital to the efforts being made by Local 26 to get rid of a BAD Player, Power Design, in contracting in the Metro area. To read more about the efforts Local 26 has made to bring down such nonunion companies, check out the 4th Quarter 2018 IN Charge magazine.

|

|

|